Is it unremarkable for a company’s CEO, COO and a Director to all resign within a two day period? Steven Kiel seems to think so.

Kiel is the largest shareholder and once again CEO of the company formerly known as Sitestar, now known as the boringly generic Enterprise Diversified(SYTE). The company changed its name to reflect its disastrous series of expansions into various industries, all of which, with the exception of its investment in David Waters’ Alluvial Fund, have proven to be excellent value destructors.

It is no secret that I have long disagreed with Mr. Kiel’s approach, and felt he behaved in a self-interested way that was against the interest of shareholders. I no longer own any stock in this company, but continue to follow it out of a sense of morbid curiosity. It is a train wreck from which I cannot avert my gaze. I kept my mouth shut when the company entered the value trap HVAC business. I remained silent when the company bought former Chairman Jeffrey Moore’s real estate business, hailing its great potential, and within months, reversed course and terminated the relationship.

Encouraged by others, however I felt a need to speak out now. On May 6, the company filed an 8-K. Among other things, the report disclosed the resignation of the CEO, the COO, and a Director.

Effective April 30, 2019, G. Michael Bridge resigned from his positions as President and Chief Executive Officer of Enterprise Diversified, Inc. (the “Company”) and as a member of the Board of Directors (the “Board”) of the Company.

Effective April 30, 2019, Rodney E. Lake resigned as the Company’s Chief Operating Officer.

Effective May 1, 2019, Christopher T. Payne resigned as a member of the Board of the Company. Accordingly, Mr. Payne’s resignation as a member of the Board of the Company included his membership on the Audit Committee of the Board (the “Audit Committee”) and the Governance, Compensation and Nomination Committee of the Board (the “GCN Committee”).

A full week passed from the time of the resignations to the time of disclosure of what is certainly material information. The company also gave no explanation as to what precipitated these resignations. The report did note the subsequent replacement of the two Directors and Mr. Kiel’s reappointment as CEO.

Four days later, on May 10, the company filed its quarterly report. Here is the entirety of the subsequent events section:

As previously reported in our Current Report on Form 8-K filed with the SEC on May 6, 2019, changes concerning certain of the Company’s executive officers and a director were made effective on Tuesday, April 30, 2019. Effective on this date, G. Michael Bridge resigned as the Chief Executive Officer and a director of the Company, and Rodney E. Lake resigned as the Chief Operating Officer and the corporate secretary of the Company.

Management has evaluated all subsequent events from March 31, 2019, through the date the unaudited condensed consolidated financial statements were issued. Management concluded that no subsequent events have occurred that would require recognition or disclosure in the consolidated financial statements.

The subsequent events make no mention of Mr. Payne’s departure on May 1, though it would clearly require disclosure. We still have no indication as to what precipitated this complete change in management. Presumably, management waited to disclose until after its investment subsidiary held an event in Omaha.

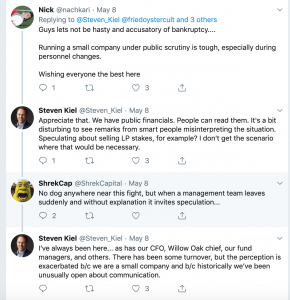

The only public comment I can find is Mr. Kiel responding to a thread on twitter that wondered if the company was in trouble and mentioned that new Director Thomas Braziel has bankruptcy experience.

Mr. Kiel continued to ignore the elephant in the room, saying that he is still there and that “smart people [are] misinterpreting the situation”. In the wake of a series of bad investments, with CEO, COO and director leaving without explanation, how else would a reasonable person interpret the situation? He also makes the dubious claim that the company has been “unusually open about communication”.

Kiel finishes by noting that “not everything within a public company can be openly shared”. That is certainly true. However, contrary to Kiel’s conclusion, a rational investor must preserve his capital and should, in fact, assume the worst in the absence of any information to the contrary. The pattern of facts that we know, with a Director resigning the day after the resignation of the CEO and COO, with no statement indicating there was no disagreement, strongly implies that the Director was unhappy about something at the company.

Oh, and one other interesting clue as well. Former CEO Michael Bridge retweeted a message warning people off from those who imitate Buffett in their speech, but not their actions.

Mr. Kiel asks for the benefit of the doubt. But his performance with Enterprise Diversified and, in particular, his failure to disclose material resignations in a timely manner suggest that investors not grant him that. Ronald Reagan often exhorted that we should “trust, but verify”. Even if one could find the room to trust Mr. Kiel, he has made verification impossible At the very least, this should be in every investor’s too hard pile. Sell it, go buy something with a management with a track record of success, and sleep better at night.

Disclosure: The author holds no position in any stock mentioned

Your comments about this company and Steve Kiel’s actions have been spot on since 2016 or thereabouts.

Fully agree that this guy is more Sardar Biglari than Warren Buffett.

Check out the 8-k filed today…