Dear Concerned Shareholders-

We are pleased to inform you that our actions regarding the henhouse have been “fully compliant with the law. However, other issues have been raised publicly about [our henhouse] business practices, and it is appropriate that they be fully reviewed. This decision to create an ad hoc committee of [foxes], which I fully support, will help free management to focus on continuing to serve [hens] and run our business.”

Sincerely,

Chief Valeant(VRX) Fox

The next phase of Valeant’s defense is out, and, if European and premarket trading is any indication, investors are unimpressed, with stock down nearly 20%. The company issued two announcements this morning. First they added G. Mason Morfit back to the Board. Morfit is the President of major shareholder ValueAct Capital.

Morfit had originally served on the Valeant Board of Directors from May 2007 to May 2014.

“I am pleased to welcome Mason back to the Valeant Board of Directors,” said J. Michael Pearson, chairman and chief executive officer of Valeant. “Although Mason has not officially been a part of the Valeant Board for more than a year, I have continued to value his vision and guidance, and I believe his insights will be invaluable during this time.”

G. Mason Morfit is President of ValueAct Capital, a governance-oriented investment fund that invests in a concentrated portfolio of public companies and works actively with their executives and boards of directors on issues of strategy, capital structure, mergers and acquisitions, and talent management. Morfit currently serves on the Microsoft Corp. board of directors and is a former director of CR Bard, Inc., Immucor, Inc., Advanced Medical Optics, Solexa, Inc., and MSD Performance, Inc. Prior to ValueAct Capital, Morfit worked in equity research for Credit Suisse First Boston’s health care group covering the managed care industry. He has a bachelor’s degree from Princeton University.

The second release, linked above, assures us that

its Audit and Risk Committee and the full Board of Directors have reviewed the company’s accounting for its Philidor arrangement and have confirmed the appropriateness of the company’s related revenue recognition and accounting treatment.

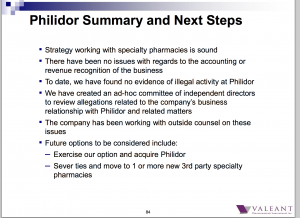

Based on its review conducted to date, Valeant also believes that the company is in compliance with applicable law. In light of the recent allegations made regarding Philidor, however, the Board of Directors has decided to establish an ad hoc committee of the board to review allegations related to the company’s business relationship with Philidor and related matters. The committee will be chaired by Robert Ingram, the company’s lead outside director. Other members will include Norma Provencio, chairman of the audit and risk committee; Colleen Goggins; and Mason Morfit, who has been appointed to the Board as an independent director.

So, everything is cool, trust us, but we’ll check again. Perhaps Peter Parker should be on the committee. The company also filed its 10-Q this morning, revealing for the first time a criminal subpoena for actions in its Bausch & Lomb division.

On September 15, 2015, B&L received a subpoena from the United States Department of Justice regarding payments and agreements between B&L and medical professionals related to its surgical products Crystalens® IOL and Victus® femtosecond laser platform. The government has indicated that the subpoena was issued in connection with its criminal investigation into possible violations of Federal health care laws. B&L is cooperating with the government’s investigation.

Lastly, the company released the slides for its conference call which will take place later today.

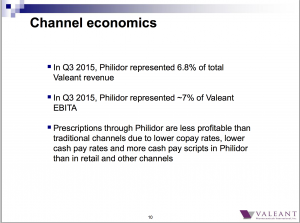

On slide 10, the company claims that “prescriptions through Philidor are less profitable than traditional channels”, yet on the same slide, Philidor represents a higher percentage of EBITA than of revenue.

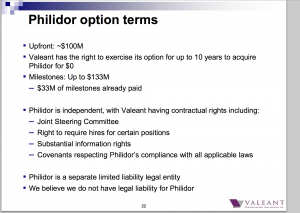

So, Valeant doesn’t own any of Philidor, but has paid $133 million so far for the right to buy it for free. And it has control over key decisions. I’m not an expert here, but if it looks like a duck and walks like a duck and quacks like a duck… then it looks like Valeant owns Philidor in all but name.

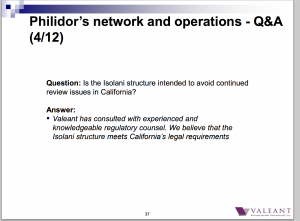

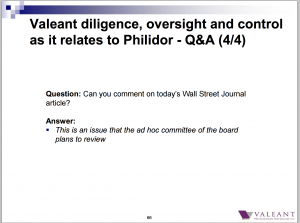

Question: Are you trying to avoid review issues in California? Answer: Don’t worry, it’s legal. Good to know that it’s legal, but that wasn’t the question that you asked yourselves.

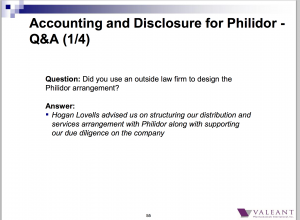

But they did not advise on the option/unusual ownership structure?

Peter Parker was unavailable for comment, but we’re hoping Spider-Man will testify.

Here we go- future options to be considered- sever ties. This is the only move Valeant can make now, but it should have done it this morning. Waiting longer and trying to explain only makes the problem worse.

Disclosure: The author owns Valeant puts