As reported previously, Berkshire Hathaway(BRK-B,BRK-A) announced its intention on August 25, 2010 to propose to Wesco(WSC) that it purchase the 19.9% of Wesco it did not already own. This morning, at long last, the two companies have announced a definitive merger agreement. Wesco shareholders will be able to elect cash or stock at what seems like a negligible premium(and a complex calculation). The total consideration for the 19.9% of shares being purchased is estimated at $547.6 million. From the press release:

The merger agreement provides that each share of Wesco common stock not owned by Berkshire Hathaway will be converted into the right to receive an amount, either in cash or Berkshire Class B Common Stock, at the election of the shareholder, equal to: (i) $386.55 (which represents Wesco’s per share shareholder’s equity as of January 31, 2011, estimated for purposes of the Merger Agreement), plus (ii) an earnings factor of $.98691 per share per month from and after February 1, 2011 through and including the anticipated effective time of the merger (pro rated on a daily basis for any partial month), plus or minus (iii) the change in net unrealized appreciation of Wesco’s investment securities and the amount of net realized investment gains or losses with respect to Wesco’s investment securities (expressed on a per share basis, net of taxes) from February 1, 2011 to the close of business on the second full trading day prior to the date of the special meeting of the shareholders of Wesco to vote on the transaction (the “Determination Date”), minus (iv) the per share amount of cash dividends declared with respect to Wesco’s common stock having a record date from and after February 4, 2011 through and including the anticipated effective time of the merger, and minus (v) certain fees and expenses incurred by Wesco in connection with the transaction (expressed on a per share basis). From time to time, Wesco will update and make publicly available on its website (www.wescofinancial.com) its estimate of the merger consideration per share of Wesco common stock.

For Wesco shareholders electing to receive their merger consideration in shares of Berkshire Class B common stock, the exchange ratio will be based on the average of the volume-weighted average price (commonly called the “VWAP”) per share of Berkshire Class B common stock for the period of 20 consecutive trading days ending on the Determination Date. The final merger consideration will be made publicly available through the filing of a Form 8-K by Wesco no later than 9:30 a.m., Eastern time, on the first business day following the Determination Date.

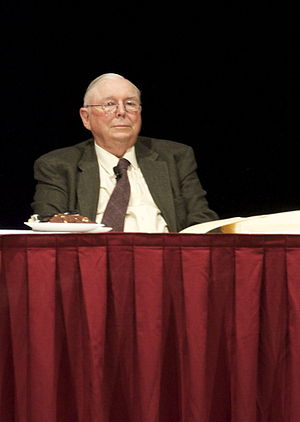

In what may be a first, the press release addresses what will happen if the transaction closes before Wesco’s next annual meeting. This is of great concern to those have attended each year to hear Charlie Munger answer questions. The statement reassures us that

if the merger is consummated prior to early June 2011, there will be no 2011 annual meeting of Wesco’s shareholders. In that event, Charles T. Munger plans to hold an “Afternoon with Charlie” in Pasadena, California sometime within a few weeks after the merger to give Berkshire Hathaway and former Wesco shareholders a chance to ask him questions about business, economics and life (but not about Wesco). That event would be held on May 4, 2011 if the merger has been consummated before then.

Wesco shareholders can now vote in favor of the transaction with confidence, knowing that they will still have their annual “Afternoon with Charlie”, at least for one more year.

Disclosure: The author owns shares in Berkshire Hathaway.